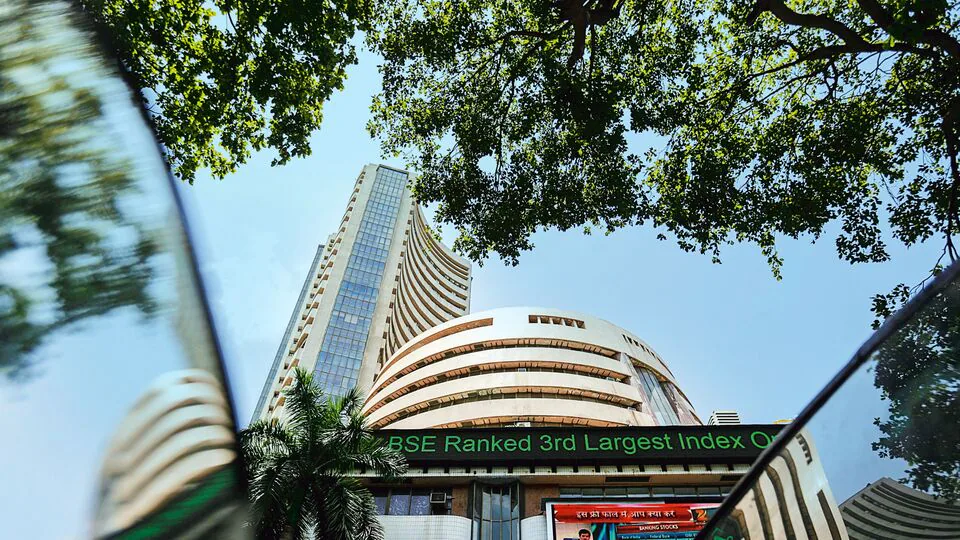

Stay updated with the latest movements in Nifty and Sensex. Explore stock market trends, sectoral updates, and expert insights for today’s trading session.

The Indian stock market continues to be a reflection of both global cues and domestic developments. Investors and traders closely monitor the performance of benchmark indices like Nifty 50 and Sensex, as they act as the pulse of India’s economy. Today, markets opened on a mixed note as global uncertainty, coupled with domestic corporate earnings, shaped investor sentiment.

Global Factors Impacting Indian Equities

One of the biggest drivers of the market today is global economic news. The U.S. Federal Reserve’s stance on interest rates and global crude oil prices remain crucial. A dip in crude oil offers relief to India, being a large oil importer, while a strengthening U.S. dollar puts pressure on the rupee. Asian and European markets have shown volatility, and Indian traders are mirroring this trend.

Sectoral Performance

The banking sector continues to dominate market discussions, with strong Q1 results boosting investor confidence. PSU banks in particular are showing positive momentum. On the other hand, IT stocks remain subdued due to concerns over global demand and rising costs in foreign markets.

The auto sector is witnessing renewed buying interest, fueled by festive season demand and electric vehicle adoption. FMCG companies are seeing steady gains as rural demand shows signs of recovery.

Institutional Activity

Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) remain key players in daily movements. FIIs have been cautious, with selective buying in energy and banking, while DIIs have been providing consistent support to the market, preventing deeper corrections.

Technical Levels for Traders

On the technical front, Nifty 50 faces resistance near 25,000 levels, while immediate support lies around 24,600. Sensex has psychological resistance at 82,000 and support at 81,000. Traders are advised to keep a close eye on these levels for intraday strategies.

Outlook Ahead

Going forward, the next big market movers will be India’s GDP data and the Reserve Bank of India’s monetary policy. With inflation under control, the RBI is expected to maintain a stable stance, which could support equity sentiment.

In summary, the Indian stock market today is navigating global uncertainty while remaining resilient due to strong domestic fundamentals. Traders are advised to follow a balanced approach, keeping an eye on both international trends and domestic earnings.