Discover how AI is revolutionizing ESG investing and sustainable finance through climate risk modeling, green loan analysis, and automated ESG scoring systems.

🤖 Introduction

In 2025, the worlds of artificial intelligence (AI) and environmental, social, and governance (ESG) investing are becoming inseparable. As sustainability takes center stage in finance, institutions are turning to AI tools to process vast data, manage risk, and uncover opportunities in ways human analysts never could.

From climate risk analysis to real-time ESG scoring, AI is not just a support system—it’s becoming the backbone of sustainable finance. Here’s how this powerful technology is reshaping how investors, banks, and regulators evaluate ESG performance and fund a greener future.

🌱 What Is ESG Finance?

ESG finance refers to investment strategies and financial products that integrate environmental, social, and governance factors into decision-making. Investors today don’t just care about profits—they also want their capital to support clean energy, human rights, fair labor, and ethical governance.

Common ESG-linked instruments include:

- Green bonds

- Sustainability-linked loans

- Impact funds

- Climate-aligned infrastructure projects

But the challenge has always been measuring ESG outcomes accurately. That’s where AI steps in.

💡 How AI Enhances ESG Analysis

AI brings speed, scale, and objectivity to ESG data analysis. Here’s how:

1. Automated ESG Scoring Systems

AI algorithms can ingest millions of data points—annual reports, news articles, social media, and NGO ratings—to calculate real-time ESG scores for companies.

This automation reduces manual analyst bias, increases transparency, and allows investors to compare thousands of companies at once based on consistent metrics.

2. Climate Risk Modeling

Advanced AI tools now simulate how climate risks—like rising sea levels or extreme heat—will impact physical assets, supply chains, and regional economies over time.

This is crucial for:

- Insurers assessing disaster exposure

- Banks evaluating long-term loan risks

- Governments planning resilient infrastructure

AI’s predictive power allows institutions to build climate-adjusted financial models, making long-term planning more realistic.

3. Green Loan & Bond Analytics

With billions being poured into green finance, institutions must ensure that the funds actually support environmental outcomes.

AI systems now:

- Track project progress via satellite imagery

- Verify emissions reductions through IoT data

- Detect greenwashing by cross-referencing financial and environmental disclosures

This boosts investor confidence and regulatory compliance.

🏛️ Institutional Adoption of AI in ESG

Global financial institutions are increasingly embedding AI in their sustainability practices:

- BlackRock uses machine learning to analyze ESG disclosures from over 20,000 companies.

- JP Morgan deploys natural language processing (NLP) tools to extract ESG insights from unstructured data.

- HSBC uses AI to assess biodiversity risk in its project finance portfolios.

Even central banks and regulators now use AI to conduct climate stress tests—gauging how banks and insurers would perform under environmental shocks like carbon taxes or severe floods.

🌍 Bridging the Data Gaps

One of ESG’s biggest issues has been inconsistent data. Many firms underreport or selectively disclose sustainability information.

AI helps overcome this by:

- Aggregating alternative data sources, like satellite data and news reports

- Filling in missing metrics using statistical modeling

- Flagging suspicious or outdated reports for manual review

This creates a more accurate and holistic ESG picture than traditional methods.

🔐 Challenges and Concerns

Despite its benefits, AI-powered ESG finance faces hurdles:

- Algorithm bias can replicate societal inequities if training data isn’t diverse

- Lack of global ESG data standards still causes inconsistencies

- Cybersecurity risks increase as more sensitive data is digitized

- Over-reliance on automation may reduce human judgment in ethical dilemmas

Therefore, a hybrid approach—AI + human oversight—is emerging as the gold standard.

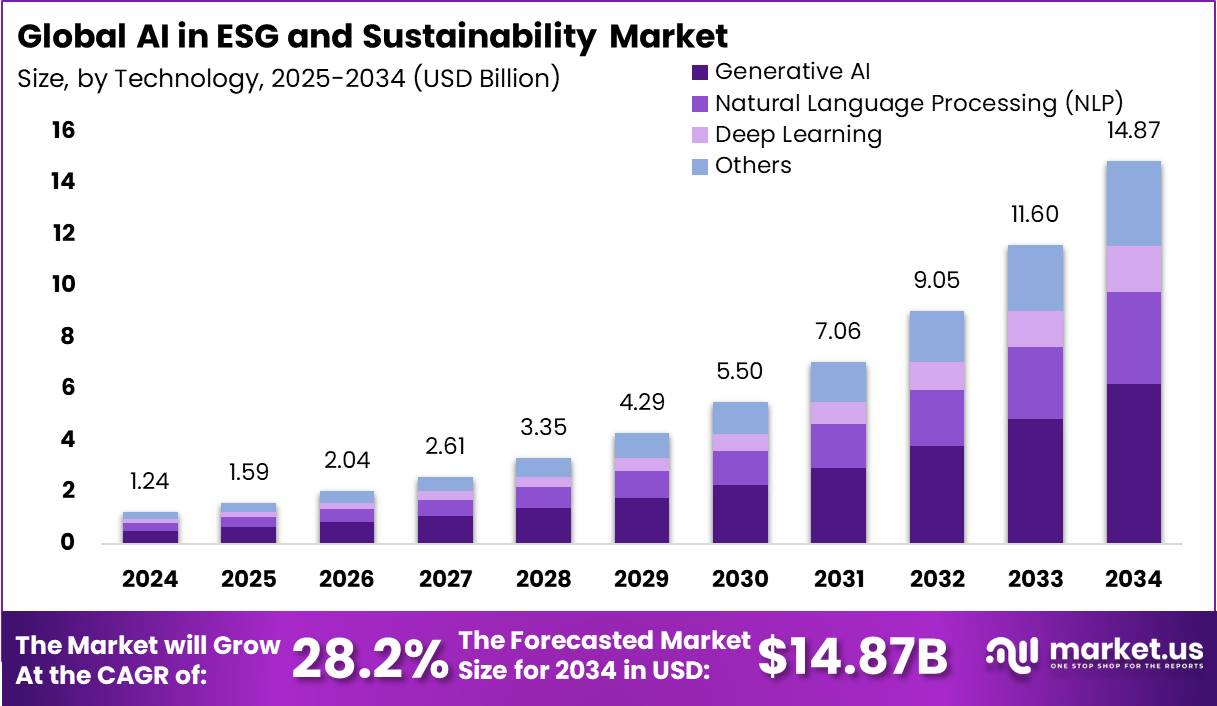

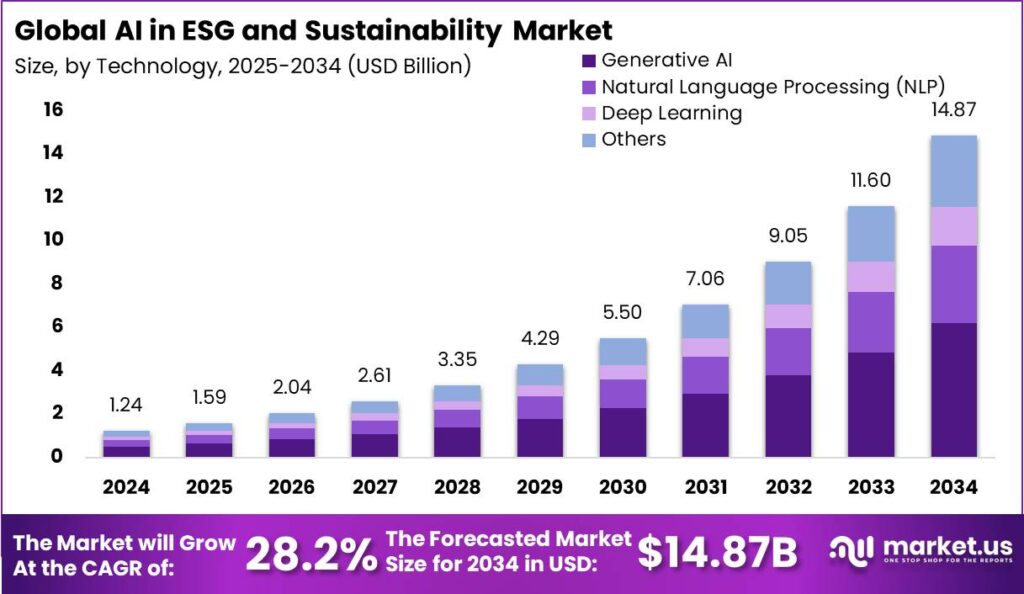

📈 The Future of Sustainable Finance with AI

In the next few years, expect to see:

- Personalized green investment portfolios created by AI advisors

- Carbon credit marketplaces powered by blockchain and AI

- Real-time ESG dashboards for retail and institutional investors

- AI-regulated ESG ETFs with automatic rebalancing based on updated scores

As regulators develop clearer ESG definitions and disclosure rules, AI’s role in enforcing, monitoring, and optimizing sustainable investments will only grow stronger.

💬 Final Thoughts

The convergence of AI and ESG finance in 2025 is more than a trend—it’s a transformation. By making sustainability measurable, actionable, and accountable, AI is turning ESG from a checkbox into a strategy that delivers real environmental and financial value.

For investors, financial professionals, and policymakers, embracing AI isn’t just smart—it’s essential for building a resilient and responsible financial future.

If you’re planning to enter ESG investing or build sustainability-aligned portfolios, now is the time to understand how algorithms are leading the green charge.