Gold continues to climb in 2025. Should investors treat it as a safe haven or reconsider its risks?

Introduction

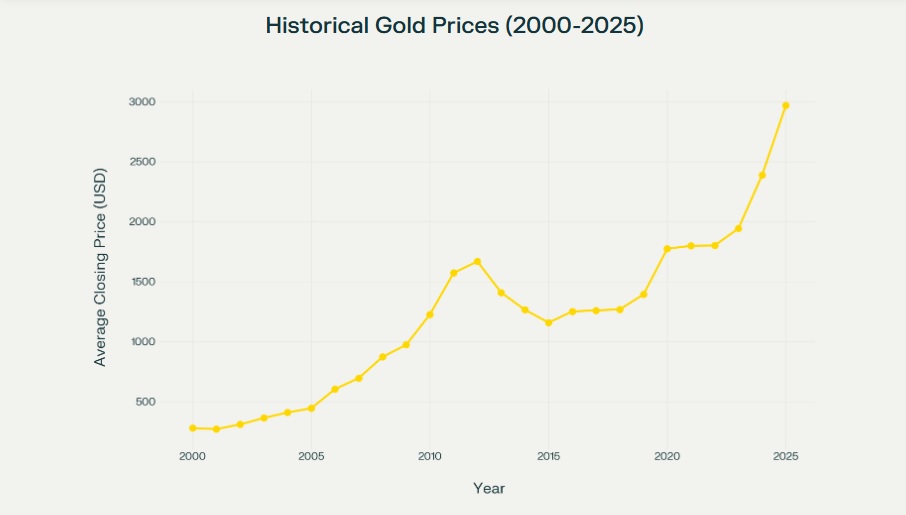

Gold has long been considered the ultimate safe haven, and 2025 is no exception. As economic uncertainty continues, gold prices have surged, attracting both retail and institutional investors. But is gold truly the safe haven it promises, or are there risks that could challenge its long-standing reputation?

Why Gold Prices Are Rising

Several factors are fueling gold’s rally. Global inflation pressures, geopolitical conflicts, and weakening confidence in fiat currencies are pushing investors toward tangible assets. Central banks are also increasing their gold reserves, adding to demand.

The Case for Gold as a Safe Haven

Gold offers stability in times of crisis. Unlike stocks or bonds, it is not tied directly to corporate earnings or government policy. Historically, gold has preserved wealth during recessions, wars, and inflationary cycles. For risk-averse investors, it remains a cornerstone of portfolio diversification.

The Risks of Overreliance

Despite its strengths, gold is not without drawbacks. It generates no income, unlike dividend-paying stocks or bonds. Prices can remain stagnant for years, frustrating investors seeking consistent returns. Additionally, overexposure to gold can limit opportunities in other growth assets.

Short-Term vs. Long-Term Strategy

In the short term, gold is likely to remain strong as investors hedge against uncertainty. Long-term, however, its performance depends on global stability and inflation trends. Balanced portfolios that include gold alongside equities, real estate, and digital assets tend to perform better than gold-heavy strategies.

Conclusion

Gold in 2025 continues to shine as a safe haven, but it is not a perfect investment. It works best as part of a diversified portfolio, offering stability while allowing investors to benefit from growth in other sectors.