Explore how FP&A leaders are leveraging AI, driving ESG reporting, breaking silos & earning CFO roles in 2025 finance functions.

As we move into the second half of 2025, Financial Planning and Analysis (FP&A) professionals are no longer just spreadsheet experts—they are becoming strategic decision-makers at the heart of business transformation. With the explosion of artificial intelligence (AI), rising pressure for environmental, social, and governance (ESG) compliance, and a growing demand for data integration, FP&A roles have evolved rapidly.

This blog explores the top FP&A trends for July 2025, how finance teams are adapting, and why FP&A professionals are now being viewed as future CFOs in many organizations.

🤖 1. AI-Powered Forecasting Is Now the Standard

Gone are the days of relying solely on historical data and manual modeling. In 2025, AI and machine learning tools are helping FP&A teams deliver faster, more accurate forecasts—often in real-time.

From predicting revenue fluctuations to analyzing market shifts, AI tools integrate multiple data streams—finance, operations, HR, and even customer behavior—to provide dynamic planning capabilities. Many finance teams are using tools with natural language processing to generate reports, scenario plans, and predictive models within minutes.

Key benefits of AI in FP&A:

- Enhanced data accuracy and integrity

- Real-time scenario modeling

- Reduction in manual workloads

- Better alignment between finance and strategy

For FP&A leaders, AI has become more than a tool—it’s a competitive advantage.

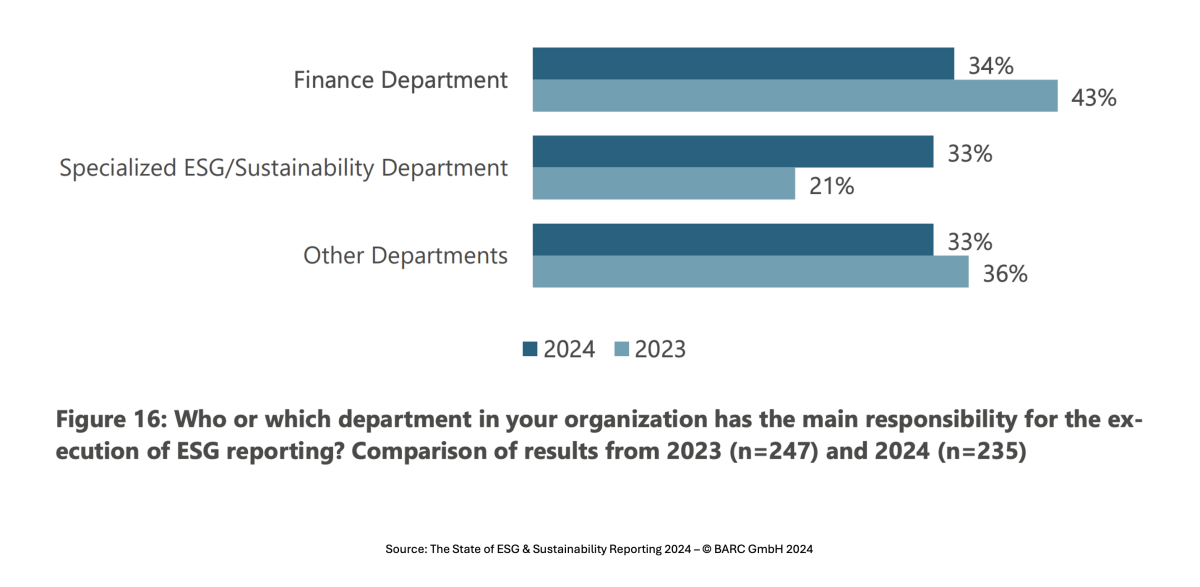

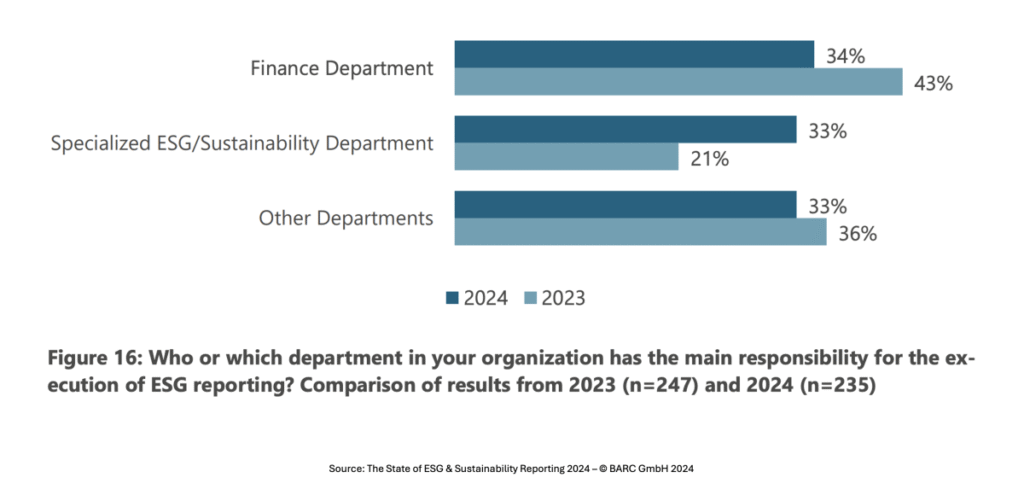

🌿 2. FP&A Takes the Lead on ESG Reporting

Another defining trend in 2025 is the increasing integration of ESG metrics into financial planning. Companies are no longer separating sustainability reports from financial performance; instead, they’re aligning them under a unified data umbrella.

FP&A teams are now expected to:

- Forecast carbon costs and climate-related risks

- Track ESG investments and returns

- Integrate non-financial KPIs into financial models

- Report on ESG compliance for regulatory bodies

With governments tightening ESG disclosure requirements (especially in the EU, U.S., and Southeast Asia), organizations are turning to their FP&A teams to lead ESG performance tracking and scenario planning.

This trend is rapidly expanding the FP&A role into one that combines financial intelligence with environmental and social accountability.

🧩 3. Breaking Down Silos Across the Enterprise

FP&A is no longer confined to monthly reports or budgeting cycles. Modern teams are actively collaborating with marketing, operations, supply chain, and HR to build a real-time view of the business.

This cross-functional integration means:

- Finance teams are embedded into strategic decisions across departments

- Rolling forecasts incorporate live data from multiple sources

- Departments are empowered with self-service analytics tools curated by FP&A

The ability to connect enterprise data and act as a strategic advisor is turning FP&A into the “central nervous system” of modern organizations.

🧑💼 4. FP&A: A Pipeline to the CFO Role

Today’s CFOs are no longer just financial stewards—they are growth strategists, tech enablers, and transformation leaders. And many of them are rising from FP&A backgrounds.

Why FP&A is the new launchpad to CFO:

- Deep understanding of financial modeling and business planning

- Experience with digital transformation and AI integration

- Regular collaboration with executives and business unit heads

- Strategic thinking in scenario analysis and capital allocation

Recruiters and boards now value FP&A professionals with a blend of technical skills, storytelling ability, and leadership presence—making them ideal candidates for top executive roles.

If you’re in FP&A today, you’re likely standing on the first step toward the C-suite.

📈 5. Key Skills for the Modern FP&A Pro in 2025

To succeed in this evolving landscape, FP&A professionals need to go beyond Excel and financial statements.

Top skills in demand:

- AI literacy: Understanding and applying predictive models

- Data storytelling: Explaining complex data in simple, impactful ways

- ESG knowledge: Integrating sustainability into financial plans

- Strategic mindset: Connecting financial goals with business vision

- Collaboration tools: Familiarity with platforms like Power BI, Tableau, and cloud ERP systems

Investing in these capabilities isn’t optional—it’s the difference between being a number cruncher or a decision-maker.

✅ Conclusion

In 2025, FP&A professionals are playing a larger, more dynamic role than ever before. Whether it’s leveraging AI, driving ESG integration, breaking down silos, or stepping into executive leadership, the FP&A function is undergoing a profound transformation.

For businesses, the message is clear: Empower your FP&A teams with the tools and influence they need. And for finance professionals? Stay ahead of the curve by embracing technology, collaboration, and strategy.

The future of finance isn’t just about numbers—it’s about insight, foresight, and action. And FP&A is leading the charge.