📢 Trump Shakes Global Markets With Massive New Tariffs

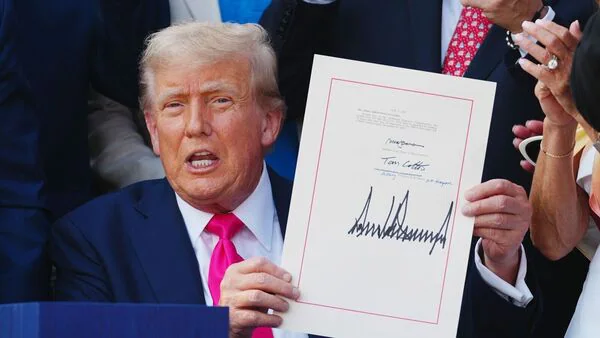

On July 7, 2025, former U.S. President and Republican front-runner Donald Trump announced a sweeping plan to impose 40% tariffs on imports from 14 Asian countries, including China, Japan, South Korea, India, and Vietnam. The proposal, framed as part of his “America First Trade Revival” agenda, has sent shockwaves across global markets, sparking fears of a new U.S.-Asia trade war.

The announcement came during a campaign rally in Cleveland, Ohio, and was later confirmed by his senior economic advisers.

📦 What Are the New Tariffs?

Trump’s tariff plan involves:

- 40% import duty on electronics, automobiles, steel, textiles, and machinery

- Applied to 14 countries labeled as “unfair trade competitors”

- Special focus on semiconductors and EVs (electric vehicles)

- Plan to withdraw from multiple trade agreements signed post-2020

He claims the move is needed to “restore American manufacturing and punish countries that manipulate their currencies and flood our markets.”

🌏 Who Is Affected?

The countries listed under Trump’s proposed tariff regime include:

- China

- India

- Japan

- South Korea

- Vietnam

- Thailand

- Indonesia

- Philippines

- Malaysia

- Bangladesh

- Taiwan

- Pakistan

- Sri Lanka

- Cambodia

Together, these countries account for over 45% of U.S. imports in sectors like consumer electronics, apparel, automotive components, and telecom equipment.

💥 Global Reactions: Panic & Pushback

🇯🇵 Japan:

The Nikkei stock index dropped 2.5% following the announcement. Japan’s Ministry of Trade issued a statement saying:

“These proposed tariffs are a setback to multilateral trade progress.”

🇮🇳 India:

The Indian Commerce Ministry is reviewing the impact, especially in textile, pharma, and software services. India exported over $90 billion to the U.S. in 2024.

🇨🇳 China:

China called the move “provocative and protectionist,” hinting at retaliatory tariffs on U.S. agricultural and aerospace imports.

🇺🇸 Wall Street:

The Dow Jones dipped by 300 points, while manufacturing stocks rose on hopes of reshoring.

💼 Impact on Global Businesses

Many multinational companies are bracing for turbulence:

- Apple and Samsung may see product costs rise due to reliance on Asian manufacturing.

- Automakers like Toyota and Hyundai could face price hikes of up to 20% in the U.S. market.

- Retail chains dependent on cheap imports from India and Vietnam are already reevaluating supply chains.

Analysts warn that consumer prices in the U.S. could spike 8–10% in affected categories, especially electronics and clothing.

🔄 A Repeat of the 2018 Trade War?

The move is reminiscent of Trump’s 2018–2020 trade war with China, which resulted in:

- A global slowdown

- Disruption in supply chains

- Volatility in commodity prices

- Long-term inflationary effects in the U.S.

While his 2025 proposal is broader, targeting multiple nations at once, experts fear a more aggressive global retaliation this time around.

🎯 Trump’s Rationale

Trump claims that U.S. companies have been at a competitive disadvantage for decades due to:

- Currency manipulation by Asian economies

- Government subsidies for exports

- Intellectual property theft (esp. China)

- Outsourcing of U.S. jobs

In his own words:

“We will not allow America to be used anymore. We will tax their products until our factories reopen!”

Supporters argue that these tariffs may revive American industries in rust-belt states like Michigan, Ohio, and Pennsylvania.

🧠 What Economists Are Saying

Not all economists agree with Trump’s plan.

Pros:

- Encourages domestic manufacturing

- Reduces reliance on global supply chains

- Appeals to American workers

Cons:

- Increases consumer prices

- Risks trade retaliation

- Strains U.S. diplomatic ties in Asia

- May hurt small businesses dependent on imports

According to Moody’s Analytics, a full implementation of Trump’s tariffs could shave off 0.6% of global GDP in 2026.

🛍️ What It Means for Consumers

If the tariffs go into effect, American consumers may experience:

- Higher prices on smartphones, laptops, TVs

- Delays in availability of EVs and auto parts

- Increased costs for everyday apparel and home goods

- Drop in discounts during seasonal sales (Black Friday, Cyber Monday)

Asian consumers may see fewer U.S. products in their markets if retaliation kicks in.

📆 What Happens Next?

The tariffs are currently proposed and could be implemented only if Trump wins the 2024 Presidential Election and takes office in January 2025. Until then, Congress, trade bodies, and global watchdogs will weigh in.

However, the mere announcement has already impacted global trade sentiments.

🔚 Final Thoughts

Trump’s 40% tariff proposal on Asian imports marks a turning point in U.S. foreign trade policy—again. Whether it boosts American industry or sparks a full-blown global trade war, one thing is certain: the world is watching, and the markets are reacting.

For India and other Asian nations, this is a critical moment to reassess export strategies, diversify markets, and prepare for a potentially hostile U.S. trade environment in 2025.